Multi-factor authenticationeCommerce sites can require users to sign in with something they know (for example, a password) and something they have (for example, a mobile phone). While this does not prevent cracking, it makes it more difficult for criminals to create large numbers of fake accounts, and renders it almost impossible for them to take over existing accounts. Chargebacks can happen for legitimate reasons (for example an erroneous purchase or a clerical error), but are very often the result of fraud techniques like carding. Carding executed against a website can lead to poor merchant history and chargeback penalties. The dark web, a subset of the deep web, is where anonymity and secrecy intensify. It is intentionally obscured from search engines and requires special software like Tor (The Onion Router) to access it.

Dark Web Carding Forums

Once confirmed, the card may be used for larger fraud or sold on underground forums. Carding is a type of payment fraud that involves testing stolen credit card information on merchant websites to verify if the details are still valid. Once a card is confirmed to be active, cybercriminals use it to make unauthorized purchases or sell it to others for profit. Carding is a type of financial fraud in which carders use stolen credit card information to make unauthorized purchases.

I can’t stress this enough, your point-of-sale systems should never share a network with general-purpose computers or IoT devices. We’re not just looking for individual red flags, we’re building comprehensive risk profiles based on dozens of different indicators. Modern payment processors use device fingerprinting and behavioral analytics to spot suspicious patterns.

While authorities have failed to shut it down, the forum hasn’t, fortunately, witnessed easy sailing either. For instance, in January this year, it was the target of Operation Talent, the law enforcement initiative that was coordinated by the FBI and international agencies. It’s an operation that led to Cracked losing the original domain, but didn’t disappear – it simply moved to the new address.

Data Leak Checker: Has Your Email Been Hacked?

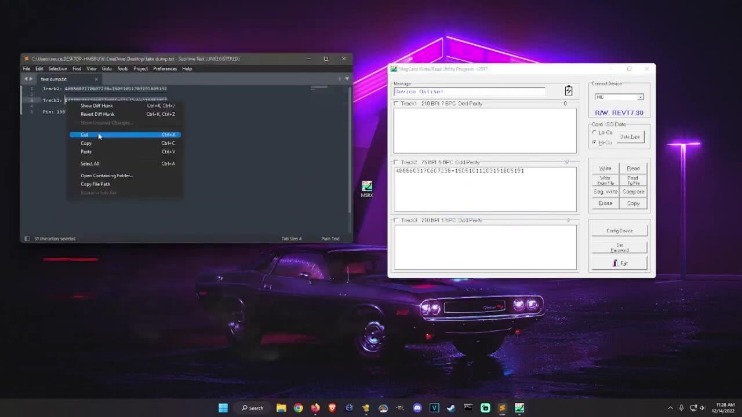

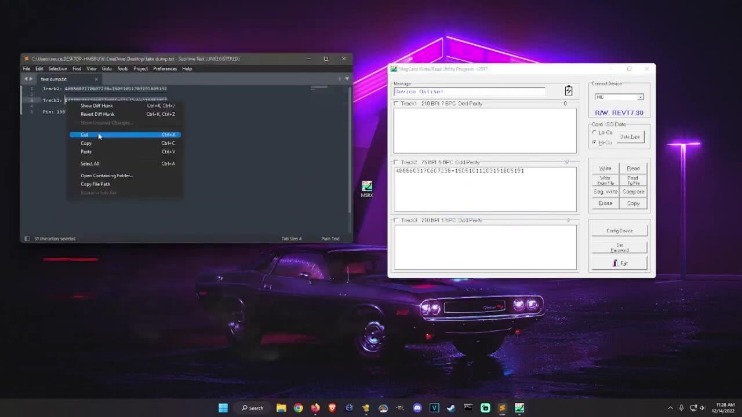

Additionally, carders themselves are vulnerable to scams and fraud within the carding community, as they often interact with fellow criminals who may exploit their trust or steal their profits. Carding has far-reaching consequences for individuals, financial institutions, and the global economy. Victims of carding often suffer financial losses, compromised personal information, and damaged credit scores. Financial institutions face significant financial burdens, as they must reimburse victims and invest in enhanced security measures. Moreover, the overall trust in online transactions is undermined, hindering the growth of e-commerce. These aren’t just random forums, they’re organized platforms where stolen card data gets packaged and sold as “fullz” (full card details including CVV) or “dumps” (raw magnetic stripe data).

B1ack’s Stash Reappears In The Media (February

This user hierarchy fosters competition and encourages members to actively contribute to the forum’s growth. A few days later, it was announced that six more suspects had been arrested on charges linked to selling stolen credit card information, and the same seizure notice appeared on more carding forums. In an era where technology facilitates seamless financial transactions, there exists a darker side where criminals seek to exploit the system. Carders are individuals involved in the illicit practice of carding, which entails unauthorized use of credit and debit card information for fraudulent purposes.

BidenCash Dark‑Web Marketplace Takedown (June

The sites I’ve evaluated this year all had clear web addresses—with ‘.onion’ versions available for some of them. Learn the basics of credit card cards, including features, fees, and rewards to make informed decisions about your credit card usage. These checkers are often offered and sold on the dark web, and are complimentary tools that individuals and organizations use to verify credit card information. The three suspects from Indonesia confessed to stealing payment card data using the GetBilling JS-sniffer family. A second major leak of cards relating to Indian banks has been detected by Group-IB, with over 1.3 million credit and debit card records being uploaded to the Joker’s Stash marketplace.

The strategy should clearly outline how information is shared with relevant stakeholders, both internally and externally. Perhaps the strategy should include a remediation process when exploits are detected during the monitoring. These tools are quite advanced; they crawl these forums and provide alerts to users if they find any of their information found in the dark part of the internet. You can even set specific keywords and phrases to watch in some cases, depending on the tool you purchase. The forum has undergone several transformations since it appeared several years ago, evolving from a platform that focuses on illicit drugs to a huge forum that’s focused on cybercrime.

Methods Used To Obtain And Sell Stolen Credit Card Information On Dark Web Marketplaces

Plenty of advertisements on cyber criminal forums offer services that install sniffer malware on target systems. This only adds another step to the carding chain, and another stage of the process that enables third parties to cream off a profit for themselves. One forum user lamented, “Give me back my 2002.” In those days, carding was a much simpler matter. Forum users are also arguing that of the payment cards they earmark for carding, fewer and fewer are valid. We found a fascinating forum thread in which one threat actor delved deep into the potential reasons. They claimed that “sniffers” (see the next section) might be misidentifying other types of data as carding data.

Additional Security Measures

Its decentralized community structure makes it one of the best forums, and its security measures help it to withstand threats like DDoS attacks. Hackers may exploit software vulnerabilities or use brute force attacks to gain unauthorized access to devices and databases containing sensitive data. When they target businesses that process transactions, like ecommerce websites, they can steal or leak large volumes of customer information in a data breach. To minimize the risk of payment data exposure, only shop from reputable retailers, use digital payment methods or one-time private cards, and protect your accounts with two-factor authentication. To combat carding, organisations employ security measures such as tokenisation, encryption, multifactor authentication, and anti-fraud monitoring systems. This guide will cover what businesses should know about carding, including how it works and how to protect themselves.

- Such type of data is likely to have been compromised online, making it a red flag for would-be fraudsters.

- Other times, they provide minimal detail, stating only the coding language the applicant needs to know and promising a “high” salary.

- But the Bankomat forum representative seems undeterred; they’ve continued to promote the shop since receiving the negative feedback.

- The business should have a clear escalation strategy that should be followed in case it detects a credible threat.

The Outseer Platform

- You can use behavioral analysis technology to analyze user behavior and detect anomalies – users or specific transactions that are anomalous or suspicious.

- The payloads it handles are likely customizable, enabling users to define specific NFC responses — a capability that could potentially be used to spoof identity-based card systems.

- Fortunately, the forums offer an option for users to operate under pseudonyms that help protect their identities.

- In recent years, the rise of cryptocurrencies, such as Bitcoin, has revolutionized the carding landscape.

- Therefore, it’s a no-brainer that businesses should implement dark web monitoring to identify data breaches, cyber risks, and several other illegal activities.

- Some carders also track your IP (Internet Protocol) address to snag your credit card info.

Cybercriminals can exploit NFC vulnerabilities to access personal information stored on devices or NFC-enabled ID cards, leading to further misuse of the victim’s identity. NFC fraud can result in significant financial losses, especially when attacks are scaled. Forexample, the “Ghost Tap” attack allows cybercriminals torelay stolen NFC payment data to make unauthorized purchases.

He joined ReliaQuest in June 2022 after working as a CTI analyst focused on cybercrime. Alternatively, they could install spyware on a victim’s computer to capture the payment-card details as they’re entered. Or it might be the old-fashioned method—using a physical ATM skimmer equipped with a recording device to gather information when a victim inserts their card into a payment machine or swipes it.

Top Dark Web Marketplaces Of 2025: A Deeper Dive Into Illicit Trade Markets

This continuous exchange of information drives the rapid evolution of cyber threats. Its stance against sharing data about Russia indicates a nuanced approach to geopolitical sensitivities. LeakBase’s vibrant community and administrative team fuel its prominence in the cybercrime landscape.