Knowledge and vigilance are key defenses against this growing problem. This extra layer of security gives peace of mind in today’s digital world. With just a few taps, people can see exactly where their money goes and catch problems early. Such type of data is likely to have been compromised online, making it a red flag for would-be fraudsters. Group-IB’s cybercrime research unit has detected two major leaks of cards relating to Indian banks in the past several months.

Million Stolen Credit Cards Given Away Free On Dark Web Forum

- That’s basically a money laundering machine because they buy all that merchandise and put it on sale on the open web.” This process turns dirty money into legitimate funds that criminals can use to buy cars, houses, and more.

- Understanding the Dark Web is crucial for detecting potential threats and taking necessary precautions to protect your credit card information.

- Regular monitoring ensures your card details stay protected while you’re abroad.

- This includes using a secure and anonymous internet connection, using a reputable VPN (Virtual Private Network), utilizing trusted marketplaces and vendors, and practicing good online security hygiene.

- Whistleblowers, journalists, and individuals living in repressive regimes often use the Dark Web to communicate securely and protect their privacy.

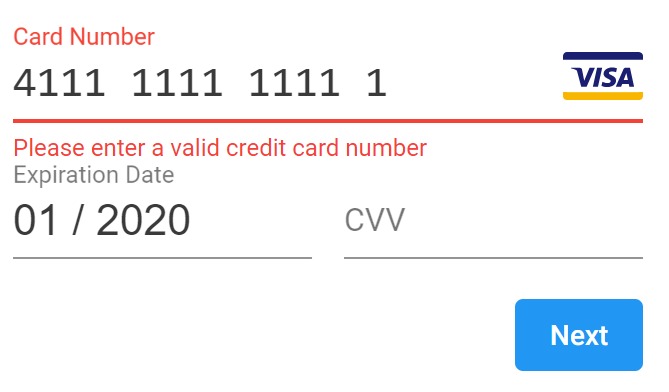

Dark Web credit cards can be a nightmare for victims, often leaving them with significant financial losses and damaged credit scores. Many cybercriminal groups announced their support for Durov and continue to rely on Telegram’s strong encryption and familiar infrastructure. In fact, credit cards are some of the cheapest such goods you can buy. Other sellers offer discounts for buying multiple cards, while the cheapest card — with between US$700 and US$1,000 on it — can cost as little as US$80. Cyber security researchers at Cyble wrote the majority of the 1.2 million cards were from U.S. users. The majority of those cards, 53% to be exact, were from American Express.

Enter A Darknet Web Address

These are hard to detect, but only using ATM machines inside banks or other physical buildings offers some protection, Thomas says. The three suspects from Indonesia confessed to stealing payment card data using the GetBilling JS-sniffer family. Canceling your credit card is a bit more complex, but you can start by contacting your bank or credit card issuer to report the card as stolen. Canceling your PayPal account or credit card is a crucial step in preventing further unauthorized transactions.

Discover How Our Specialists Can Tailor A Security Program To Fit The Needs Of Your Organization

Dark web credit cards are often sold on online marketplaces, which can be accessed through specialized browsers like Tor. Since then, BidenCash has continued to operate using the “dumping” method. This involves adding daily listings of stolen credit card details to the site and periodically dumping large amounts of stolen credit card details at the same time. Crucially, she also outlines what service providers—including telcos, financial services, and insurers—can do to help protect consumers from carding in today’s shifting cyber threat landscape. The card’s credit limit, inclusion of the CVV, billing information, and source reliability all impact prices.

However, Pompompurin was arrested on March 15, 2023, leading to BreachForums’ temporary closure. It re-emerged on June 12, 2023, under ShinyHunters, a notorious threat group. Sign up for our newsletter and learn how to protect your computer from threats. A vast majority of bank and credit card apps offer notifications and alerts for questions about suspected fraud. BidenCash apparently used the free stolen data dump to draw attention for marketing, even using an image of President Biden as its brand identity, as discovered by Cyble researchers who detected the data breach. Social media platforms like Facebook and news sites like the BBC and ProPublica have also waded into the dark web’s waters.

Acronis Cyber Protect Cloud: New Version C2505

The average price of a cloned, physical card is $171, or 5.75 cents per dollar of credit limit. Comparitech researchers sifted through several illicit marketplaces on the dark web to find out how much our private information is worth. Where possible, we’ll also examine how prices have changed over time. Learn how to automate financial risk reports using AI and news data with this guide for product managers, featuring tools from Webz.io and OpenAI.

Dark Web Credit Card Fraud: Detecting And Preventing Credit Card Fraud

Sales of passports, driver’s licenses, frequent flyer miles, streaming accounts, dating profiles, social media accounts, bank accounts, and debit cards are also common, but not nearly as popular. Based on our observations from analysis on dark web data using Lunar, we’ve identified the top 7 marketplaces on the dark web in 2025. We developed Lunar to monitor the deep and dark web, including dark web marketplace sites.

Carding has long been a prevalent form of online crime—and it remains a serious threat. One such protection is the use of anti-fraud tools, such as F‑Secure Total, our complete online security solution. These tools offer consumers the most effective way to defend against carding attacks. Accounts with higher balances are more expensive, as they provide a greater potential payoff for attackers. Banks that are preferred targets often have weaker security measures or systems allowing quick transfers. US banks and international institutions with lenient fraud detection systems are particularly popular.

Rapid response can prevent unauthorized transactions, minimize financial losses, and protect your customers’ trust in your business. Dark web monitoring platforms, such as Lunar, provide an automated solution to safeguard personal identifiable information (PII) and credit card details. These platforms continuously scour the deep and dark web, looking for any traces of your sensitive information. By setting up alerts, businesses can receive notifications whenever their PII or credit card information appears in suspicious contexts. This proactive monitoring enables businesses to track and investigate potential threats in real-time, helping to prevent fraud before it can impact their operations. The use of such platforms is crucial for maintaining the integrity and security of customer data, and it provides an additional layer of defense against cybercriminal activities.

Protecting your credit card information is crucial to avoid financial loss and potential legal troubles. By regularly monitoring your credit, using secure payment methods, and being cautious online, you can minimize the risk of your credit card falling into the wrong hands. The dark web has become a hub for credit card fraud, making it a significant concern for both individuals and businesses. Criminals can easily sell stolen credit card information to other malicious actors on the dark web, leading to potential financial devastation for victims. Personal credit card data can be exploited for various illegal activities, including making fraudulent purchases or even creating counterfeit cards. In the dark underbelly of the web, cybercriminals employ various sophisticated methods to exploit credit cards for illicit gains.

These measures include implementing robust security practices, such as encryption and multi-factor authentication, to protect credit card data and reduce the likelihood of it ending up on the dark web. These aren’t just random forums, they’re organized platforms where stolen card data gets packaged and sold as “fullz” (full card details including CVV) or “dumps” (raw magnetic stripe data). It is understood that the data included such highly sensitive information as the primary account number of the credit cards concerned, along with expiration dates and the card verification value, CVV2, security code. But that’s not all; there are also cardholder details such as their full name, address, date of birth and telephone number as well as email address. Pretty much everything you would need to commit credit card fraud or launch phishing attacks against the cardholder. Dark web credit card numbers are stolen card details sold on hidden websites.

Exploring Benefits And Risks Of Using Credit Cards Or Card

– Examine the feedback relevance and authenticity by considering the comments and overall sentiment expressed by previous buyers. – Look for a substantial number of feedback and ratings to ensure a more accurate assessment of the vendor’s performance. The Abacus Market links to the new dark web marketplace sections and took over much of the vacuum left by the AlphaBay takedown. If you ever decide to explore the dark web, protecting your identity is crucial.

Since websites are kept unindexed here, it is more complex and difficult to search for source content and obtain data than the clear web. While many people use this hidden part of the Internet, many use it to carry out illegal activities. The biggest reason malicious users prefer to use the dark web is that special software is used to enter the web pages here, providing anonymity and privacy. Dark web forums generally contain illegal trade, malware, 0day, exploit, database leakage, credit card information, etc.

BidenCash Criminal Market Leaks Over 2M Stolen Credit, Debit Card Numbers

Now that we have covered the necessary steps to access the Dark Web safely, let’s move on to the process of buying credit cards on the Dark Web. No, black market websites operate illegally and pose high risks of scams, fraud, and law enforcement action. By supplying stolen data, these dark web links fuel many online scams and identity theft operations, playing a critical role in the darker aspects of the internet. Despite growing crackdowns from law enforcement agencies, the dark web remains a hotbed of criminal activity, offering everything from drugs to stolen data.

Gizmodo reached out to the bank to ask whether those cards have been terminated and if any had been used for fraudulent transactions since the card numbers were released, but we did not immediately hear back. Other card issuers included the likes of Wells Fargo Bank, U.S. Bank, and Bank of America. Certain regions and countries offer more lenient regulations or limited law enforcement capabilities, providing safe havens for cybercriminals.