Some are looking for illegal stuff they can’t buy elsewhere, like drugs or counterfeit documents. Today’s cybercriminals spread their activities across multiple platforms, making them harder to track and shut down. Then you’ll set up your account to make sure you can access CreditWise, even if you forget your password. If you’re a current Capital One customer, you can use your existing online credentials to access CreditWise. Changelly makes it easy to buy Bitcoin instantly with a credit or debit card. Choose from 20+ payment methods, benefit from low fees, and enjoy fast transactions—all in one place.

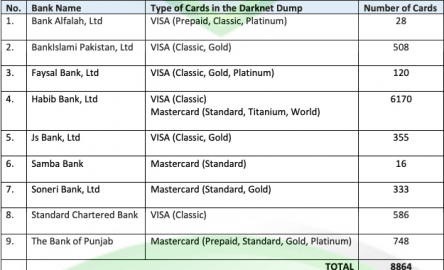

In June 2022, BidenCash released over 7.9 million payment card data dating from 2019 to 2022 on a cybercrime forum. However, the dump only contained 6,581 records exposing credit card numbers. Underground carding marketplaces are crucial components of the cybercrime ecosystem, they facilitate the sale and purchase of payment card data. One of the most popular carding site was Joker Stash, its operators retired in February 2021 and shut down their servers and destroyed the backups.

I can’t say for certain, but I’ve always seen carding as a more ‘hardcore’ form of cyber crime—at least from a criminal’s perspective. Compared to harvesting phone numbers or email addresses, carding demands more risk, and potentially, more reward. The release of this data poses significant risks for financial institutions and individual cardholders alike.

Top Strategies For Risk-Based Transaction Monitoring

And then there’s malware—click the wrong link or download the wrong file, and your device could get infected. All of these features, its competitive pricing, along with the volume of credit card information listings, make Real and Rare one of the prime sites to trade credit card information online. While comparisons have been drawn to now-defunct platforms like Joker’s Stash, B1ack’s Stash appears to be a distinct operation aiming to establish itself as a major player in the underground economy. Its presence across multiple dark web forums, coupled with an active Telegram channel, indicates a calculated effort to build trust and legitimacy within illicit communities. The technique of making free data available to promote a site is nothing new, other well-known carding marketplaces, such as BidenCash and Joker’s Stash, operate similarly. A vast majority of bank and credit card apps offer notifications and alerts for questions about suspected fraud.

‘CyberGuy’ Warns New IPhone Update Will Have ‘big Effect’ On Political Fundraising

A dump of hundreds of thousands of active accounts is aimed at promoting AllWorld.Cards, a recently launched cybercriminal site for selling payment credentials online. Upon investigation, it was found that a compromised third-party vendor was the cause of this data breach. This revelation emphasized the need for robust cybersecurity across the organization, including third-party and other external business associations. While the settlement itself proved quite expensive, the breach cost Target business losses to the tune of approximately $200 million and a 46% drop in earnings. Not to mention the resulting tarnished reputation, which required extensive post-event damage control. AllWorld Cards has been active since May 2021 and currently holds an inventory of over 2,749,336 credit cards, with an average price per card of $US 6.

Access Exclusive Templates

Financial data can leak in many ways—through phishing attacks, data breaches at online services, or poor account security. Even in regions like the EU, where banks are legally required to implement strong customer authentication, criminals continue to find ways to bypass these safeguards. In the relentless battle against cyber threats, financial institutions must deploy proactive strategies and technologies to mitigate risks and protect customers, especially in the context of compromised credit card feeds. Additionally, securing transactions with a 3-D Secure ACS (Access Control Server) solution plays a pivotal role in bolstering the overall fraud prevention strategy. This is because resellers of stolen card data are likely to pivot to other large-scale dump forums. The underground payment card economy is “likely to remain largely unaffected by this shutdown,” researchers write.

Ready To Explore Web Data At Scale?

We all know what happens to the data stolen by hackers if the ransom isn’t paid up — it ends up somewhere on the darknet for sale to anyone with a questionable moral compass and money to spend. Firstly, be vigilant when using your card at physical locations like ATMs, gas stations, or restaurants. Thieves might install skimming devices on these machines to steal data from your magnetic strip. Inspect the card reader before inserting your card, looking for any signs of tampering such as additional hardware or uneven surfaces.

Why Are All The Darknet Markets Down

In recent years, I’ve observed some shifts in how carding is carried out—changes that mirror broader developments in both technology and threat intelligence research. Notably, cryptocurrency has become a valid option for carding operations, whether through exploiting stolen crypto wallets and accounts or using stolen credit card details to purchase cryptocurrency. Post the dismantling of Joker’s Stash, cybercriminals displayed adaptability by establishing new marketplaces to fill the void, highlighting the resilience of criminal enterprises. This adaptability underscores the ongoing challenge faced by financial institutions in combating the ever-evolving threat of dark web credit card marketplaces. Much like the situation after Silk Road was taken down, out of the ashes of Joker’s Stash, we have seen dozens of new carding data providers crop up, some specializing in particular regions or types of card data. Over the past decade, Joker’s Stash emerged as one of the most infamous dark web marketplaces, gaining notoriety for illicit transactions and offering a plethora of stolen financial data.

Frequently Asked Questions (FAQs) About Dark Web Marketplaces

Routinely reviewing credit card statements for unauthorized or suspicious transactions can help users detect anomalies in expenditure patterns. If detected, users must report such discrepancies to the card issuer immediately. Let us look at some credit card dump examples to understand the concept better. Stolen card details often end up on the dark web marketplace for a quick profit, and this can happen before you even know about it.

This massive data dump was publicized on underground cybercriminal forums like XSS and Exploit, serving both as a marketing tactic and a means to establish credibility within the cybercrime community. Credit card dumps can lead to a wide range of negative consequences for consumers, including identity theft, unauthorized transactions, and damaged credit scores. In some cases, victims may spend months or even years working to restore their financial situation. Companies that suffer from data breaches are required by law to offer free identity theft protection services to affected customers as part of their response efforts. For companies handling sensitive customer data, investing in robust cybersecurity measures is crucial. Regularly updating software and implementing multi-factor authentication are essential steps that businesses can take to minimize the risk of credit card dumps.

Credit card dumps with PIN can be acquired through various means, including data breaches, skimming devices, and phishing scams. Criminal charges such as identity theft, fraud, or computer crimes can result in imprisonment, fines, probation, or a combination of these penalties. Card theft, scams, and black markets for personal IDs have been around since the advent of credit cards in the 1960s and ’70s. To prevent dumps credit cards, individuals should be cautious when providing credit card information online or in public. Dumps credit cards can lead to significant financial losses for individuals and businesses.

- Stolen credit cards are used to cash them out or make purchases that can be resold.

- A successful breach could result in a loss of customer trust, which can negatively impact sales and revenue.

- A credit card skimmer is a device that looks like a normal card slot but is designed to secretly capture credit card information.

- By monitoring dark web markets, we often discover data breaches before they’re publicly reported.

- All websites hosting pornography will have to check the age of their users from Friday.

- Dark Web credit cards can be a nightmare for victims, often leaving them with significant financial losses and damaged credit scores.

It’s been a constant back-and-forth between cybercriminals and law enforcement, with each new site trying to be smarter and more secure than the last. The story of dark web marketplaces kicks off with Silk Road, launched in 2011. It was the first big site where people could anonymously buy drugs using Bitcoin, and it gained a lot of attention, until it was shut down by the FBI in 2013. Family Dollar is one-half of a consumer’s dream; they offer low-priced goods for families in 8,200 locations nationwide. Delta Dental of California (DDC), Delta Dental Insurance Company, Delta Dental of Pennsylvania, and other subsidiaries may have exposed data; the compromised data is not a product of the organizations.

Understanding Dark Web Websites For Credit Cards

At its core, this website provides a platform for the sale of stolen credit card information, making it a hub for cybercriminals. What adds to the intrigue is the anonymity of the operators, shrouding the website in secrecy. Despite the controversy surrounding its operations, Blackpass boasts a substantial user base and claims to have sold over 27 million dumps since its inception. To gain access to Blackpass’s offerings, users must pay a membership fee, adding another layer of intrigue to this dark corner of the internet. Comparitech researchers gathered listings for stolen credit cards, PayPal accounts, and other illicit goods and services on 13 dark web marketplaces.

Yale Lodge Card Shop

Many tracker apps link directly to bank accounts for up-to-the-minute info. They show recent purchases, account balances, and spending trends all in one place. EMV stands for “Europay, Mastercard, and Visa,” the companies that initiated the chip standard. Sometimes hackers will commit “card-present fraud” by breaching the point of the sale at a physical store.