The company paid a ransom to prevent the release of sensitive data, but hackers have resumed extortion attempts as of May 2025. The Tea anonymous dating advice app has suffered a data breach far larger than initially reported. The incident involved access to more than 1.1 million private direct messages exchanged between users from February 2023 to July 2025. These messages contained highly sensitive conversations on topics such as divorce, abortion, cheating, and rape. Allianz reported the incident to the FBI and stated there is no evidence of intrusion into its core systems, including its policy administration platform. The headlines are filled with stories of compromised personal information, stolen financial data, and disrupted services, painting a stark picture of our vulnerability.

This screen time includes everything from streaming video, scrolling social media, and browsing the web. Even in a digital age, criminals still steal mail for financial documents containing sensitive information. 3-bureau credit features & extra ID theft protection features for one adult.

Dark Web Credit Cards: Understanding The Risks And Methodologies

Card Shops are a type of dark web marketplace that hosts the trade of credit cards and other stolen financial information. These platforms serve as hubs for cybercriminals to easily buy and sell compromised payment card details, including credit card numbers, CVV codes, expiry dates, and cardholder information. Back in the day, carding forums were the busiest of online crime hangouts, selling packs of stolen credit card data to anyone with the cash.

Knowledge-sharing In The Carding Community

If cybercriminals manage to link your credit card number with other personal data, such as your name, address, or Social Security number, they can build a complete identity profile. This opens the door to applying for loans, creating fake IDs, or taking out credit cards in your name. It can take months—or even years—to recover from this kind of identity fraud.

How Does Credit Card Fraud End Up On The Dark Web?

Stolen credit cards and their details are added and bought on these shops on an hourly basis, and more and more markets launch a matching forum and/or a Telegram channel to keep expanding and supporting criminal online activity. Criminals are abusing mainstream social media applications to advertise stolen data, in this case by brazenly posting full stolen credit card data to the Threads app. Financial institutions can proactively strengthen their defences by integrating intelligence derived from FraudAction. This involves leveraging insights from compromised credit card feeds into security protocols, enabling institutions to identify potential threats, block fraudulent transactions, and enhance overall risk management. This not only protects against financial losses but also reinforces customer trust.

Genea Fertility Clinic (Australia) Information Leak

On December 26, 2024, RBFCU, the largest credit union in Texas, reported a data breach affecting over 4,600 customers. The settlement offered compensation to individuals whose Social Security numbers or financial data were exposed. Eligible claimants could receive reimbursements for out-of-pocket expenses and up to four hours of lost time at $20 per hour. All approved claimants were also eligible for two years of free credit monitoring across all three major bureaus. In March 2025, the Pennsylvania State Education Association (PSEA), a labor union representing public school employees, experienced a significant data breach.

Traveling with a credit card exposes you to risks like fraud or unauthorized transactions. Regular monitoring ensures your card details stay protected while you’re abroad. While the dark web poses a significant threat to personal and financial data, understanding and applying these robust security measures can greatly minimize the risk of card number theft.

“Their reputation score will be damaged, or they will be identified by the administration as a scammer. In the worst case, they might dox them, and reveal the identities of these individuals—their email addresses, Twitter handles—just to run that person out of business,” he says. The “dark web,” by contrast, is a layer of information that can be accessed through overlay networks. Special software and browsers, such as The Onion Router (TOR), are needed to enter the dark web because much of it is encrypted, and forums are hosted anonymously.

Unauthorized Purchases

It was linked to a broader series of attacks by the Clop ransomware group. Evide, a data storage company based in Northern Ireland, suffered a ransomware attack that compromised data from approximately 140 organizations, including charities supporting survivors of sexual abuse. Finland’s National Bureau of Investigation (NBI) has named a second suspect in the 2020 Vastaamo data breach. The suspect, based in Estonia, is accused of helping prepare extortion materials and posting stolen patient data online. The NBI worked with Estonian authorities and plans to submit the case to prosecutors on May 19, 2025.

- If you notice suspicious activity, you can pause or close your virtual card in a few clicks—–via either Privacy’s web app or mobile app—and Privacy will decline any subsequent payment requests on the card.

- The breach involved the theft of approximately 400 gigabytes of data, potentially affecting sensitive information from major financial institutions.

- Hackers accessed a third-party cloud-based CRM system used by Allianz Life Insurance Company of North America on July 16, 2025.

- In September 2024, hackers accessed and possibly removed sensitive data of over 1.4 million patients from Texas Tech Health Sciences Center’s Lubbock and El Paso locations.

- These listings can include information such as the BIN number, credit card number, expiration date, and CVV number.

Card Skimming Theft

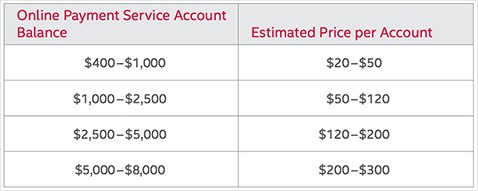

So unlike credit cards, prices for PayPal accounts and transfers have gone up during the pandemic by 293 percent. “I’ve been able to get all-inclusive trips and holidays, and my Netflix accounts and Spotify,” D2 said. He showed off his account on Deliveroo, a British online food delivery company, where he had 65 credit cards saved.

How Stolen Credit Card Information Is Sold

“In one case, they buy merchandise—for example, iPhones, iPads, even gift cards—and sell them. That’s basically a money laundering machine because they buy all that merchandise and put it on sale on the open web.” This process turns dirty money into legitimate funds that criminals can use to buy cars, houses, and more. That’s according to researchers at SpiderLabs, the hacking and investigation team of cybersecurity company Trustwave, who conducted an extensive study into what cybercriminals charge for stolen data on the dark web.

As a result, carding communities are developing new strategies to leverage existing online platforms and withdraw money from stolen credit cards. The repercussions of dark web credit card marketplaces, including the rise and fall of Joker’s Stash, extend beyond monetary losses. Financial institutions shoulder increased operational costs tied to investigating fraudulent activities and failed authentication attempts. Customers who lose their card data to fraud may turn to a different card while waiting for a replacement card, threatening the top-card effect of passing all spending across one preferred card.

Logging into your bank or shopping online while connected to public Wi-Fi can expose your credit card details. This stolen information is exploited by threat actors for financial gain through unauthorized charges, account takeover, and identity theft. The resulting financial loss is tremendous not only for the individual victim but also for the financial provider and any involved organizations. The shop offers stolen card data from around the world for as low as $0.15 per item and uses verification and automated checks to check the validity of the cards people put up for sale on the platform. Yes, you should be concerned if your credit card number is found on the dark web as it puts you at a higher risk of fraudulent transactions and financial theft.

The first breach occurred in April 2022 when a former employee accessed sensitive data on over 8 million users. A second breach followed in October 2023 involving unauthorized transactions and failed customer support. The lawsuit accused Cash App and its parent company Block Inc. of negligence and poor data protection. Moviynt disclosed a data breach involving unauthorized access to employee email accounts and files between February 27 and March 6, 2025.